Capturing Africa's Mineral Value

- Claire

- Sep 9, 2025

- 1 min read

Updated: Sep 9, 2025

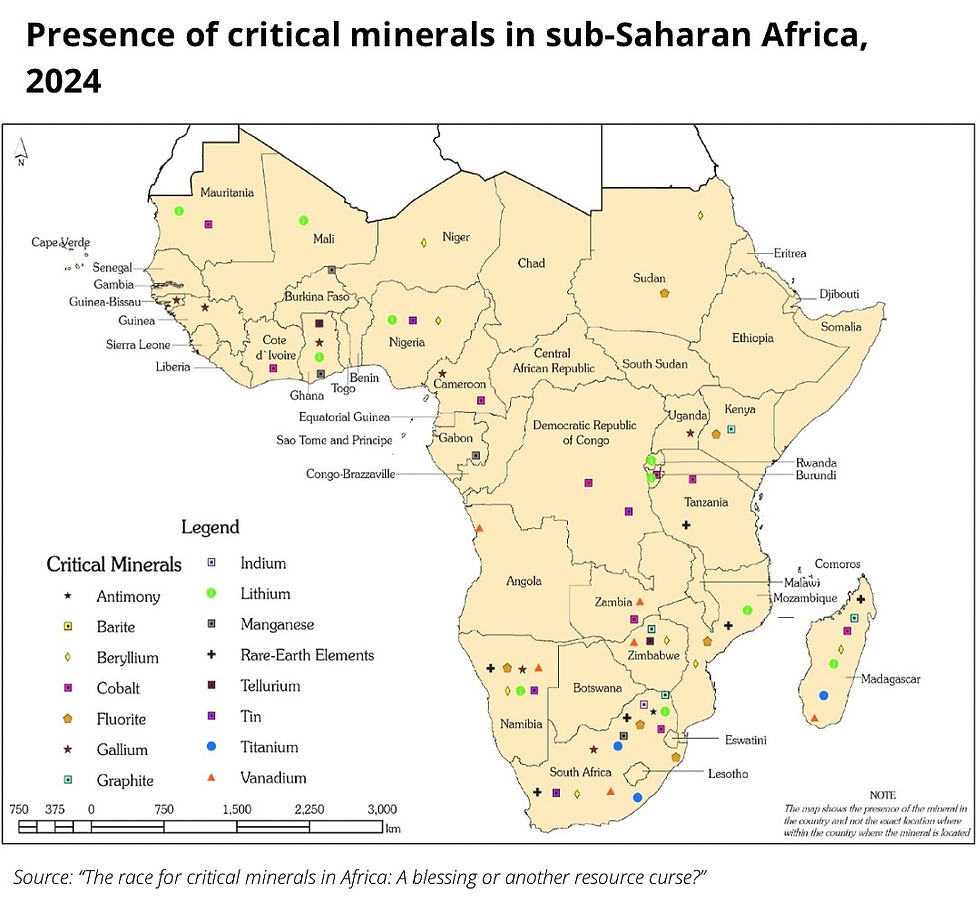

Africa stands at the center of a global supply shift, holding about 30% of the world’s critical mineral reserves, including lithium, cobalt, copper, and rare earths. The continent also accounts for over 40% of reserves in cobalt, manganese, and platinum—essential for batteries, hydrogen technologies, and clean energy infrastructure. With surging demand from AI, EVs, and renewable systems, Africa’s resource base offers both strategic promise and geopolitical leverage.

To capture value beyond raw exports, Africa is turning to innovation and partnerships. Startups are deploying digital traceability tools to strengthen supply chain transparency, while collaborations such as Critical Minerals Africa Group (CMAG) with APO Group are boosting global visibility. The African Development Bank has even proposed a “critical minerals–backed” currency to link export earnings directly to development capital. But true value capture hinges on credible governance and technology that formalizes and streamlines mineral tracking.

The opportunity is vast. The International Energy Agency (IEA) projects the market for energy-transition minerals—copper, lithium, nickel, cobalt, graphite, and rare earths—will more than double to $770 billion by 2040. Africa’s mineral investment is expected to reach $50 billion by 2040, reflecting rising investor appetite. Yet China still dominates downstream processing, especially refining and battery material production, underscoring Africa’s need to build its own capabilities.

To avoid remaining a resource backstop, Africa must act decisively. This means empowering governments with robust regulation, investing in local beneficiation, and attracting transparent global partners. Success could position the continent as a value-added powerhouse—anchoring a vertically integrated minerals ecosystem that transforms geological wealth into sustainable growth and global industrial relevance.

Source: IEA

Comments